Table of Content

Stay in the know with our latest home stories, mortgage rates and refinance tips. Depending on your financial situation, a lender may offer a rate that’s higher or lower than the average. So, it’s a good idea to do things like boosting your credit score and paying down high-interest debts. The fed funds rate began the decade at a target level of 14 percent in January 1980. By the time officials concluded a conference call on Dec. 5, 1980, they hiked the target range by 2 percentage points to percent, its highest ever.

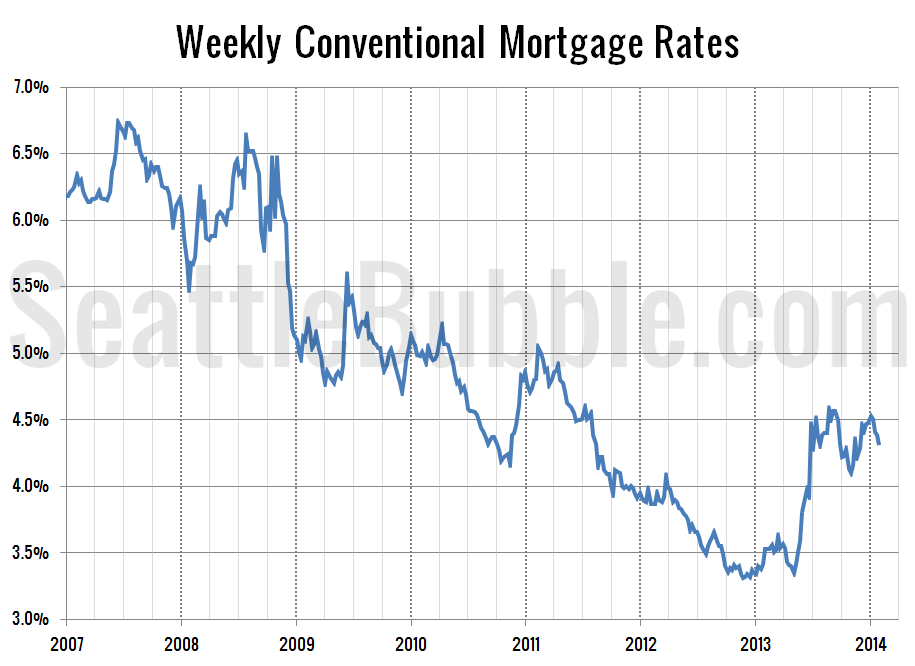

That’s an increase of nearly 400 basis points (4%) in ten months. And if the Federal Reserve decides to slow down on rate hikes, as Fed Chair Powell hinted on December 1, we could see further declines (or at least a leveling-off) in the future. Every day, get fresh ideas on how to save and make money and achieve your financial goals. Quentin Fottrell writes The Moneyist column to provide all sorts of financial advice, especially as it relates to difficult family situations. You may never have such a problem, but chances are you will know someone in similar straits.

Best Savings Account Interest Rates of December 2022

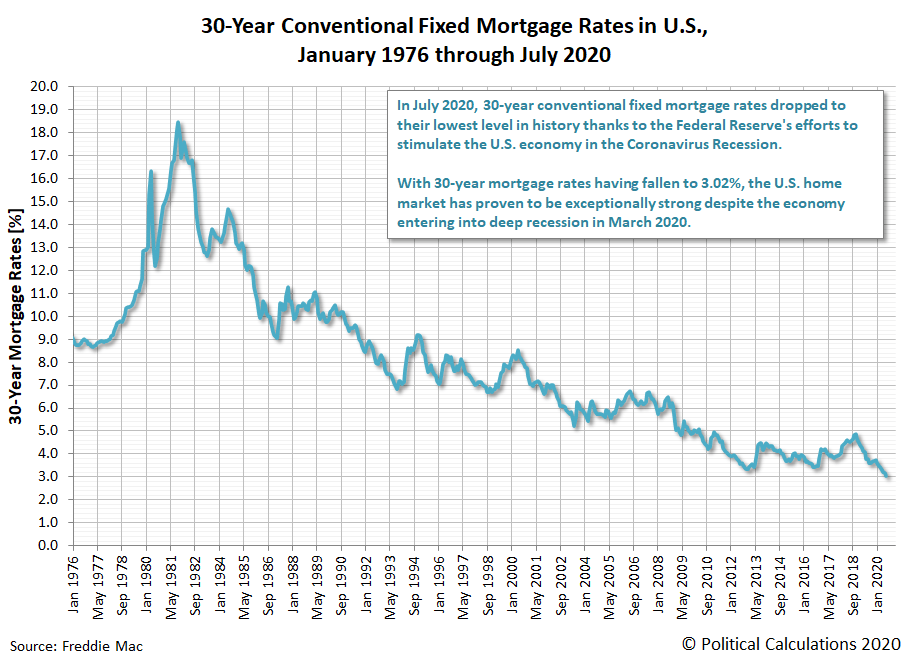

In response to the Covid-19 pandemic, the Federal Reserve pumped money into the economy, spending trillions of dollars on mortgage-backed securities to help steer the U.S. away from another financial crisis. This move allowed lenders to offer rock-bottom interest rates, tumbling to the mid-2% range by the summer of 2021. Home loans are offered at both fixed and floating interest rates.

Although individual credit standing is one of the most important determinants of the favorability of the interest rates borrowers receive, there are other considerations they can take note of. While the best mortgage rate is really the lowest one you can get, you're able to have greater context as to how low or high your rate ranks when looking at the graph from the St. Louis Federal Reserve. In June 1993, rates started to look normal again, with the average one-year CD yield sinking to 3.1 percent APY, Bankrate survey data shows. Here’s a look at the historical ups and downs of CD rates and some background on rate fluctuations through the decades.

Credit Card

This was spurred by the dot-com bubble, an era when investors rushed to buy stocks from technology companies that were overvalued. When these stocks plummeted, investors turned their focus to fixed-income investments, such as bonds. As bond prices rose and yields fell, mortgage rates, which follow the 10-year Treasury yield, also declined. Demand for mortgages can also affect rates, pushing it higher as available capital for lending tightens. A number of factors can affect your mortgage interest rate, including the total amount of your mortgage loan, the mortgage terms, and the health of the housing market. How Bonds Affect Mortgage Rates Mortgage Basics - 4-minute read Miranda Crace - October 11, 2022 The bond market and the housing market are closely connected.

We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. “Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. Robin Rothstein is a mortgage and housing writer at Forbes Advisor US. Prior to this, Robin was a contractor with SoFi, where she wrote mortgage content.

Real Estate Listings Showcase

Intraday data delayed at least 15 minutes or per exchange requirements. In an email on Dec. 15, Krosby wrote that trading activity in the federal funds futures market pointed to a terminal rate of 4.75% to 5%, with a rate cut in November 2023. Federal Reserve Chairman Jerome Powell speaks during a press conference after the central bank raises interest rates on Dec. 14. In June 2013, average yields on one-year and five-year CDs were 0.24 percent APY and 0.78 percent APY, respectively, according to Bankrate data.

The fed funds rate has never been as high as it was in the 1980s. In another scenario, the buyer prioritizes a lower home price and purchases a $300,000 house instead. By buying a lower-priced home, they’ll be able to build equity faster, which will allow them to refinance more easily.

The all-time high for mortgage rates

Bankrate.com does not include all companies or all available products. Americans watch mortgage rates closely, and any time rates pull back even the slightest amount, more people apply for mortgages. With rates still substantially higher than a year ago, however, applications remain stuck near the lowest level in more than two decades, according to MBA data.

With global turmoil, investors flocked to the safety of the U.S. bond market to guarantee the steadiness of their investments. Mortgage rates steadily declined from 8.05% in 2000 to the high-5% range in 2003. But the housing industry growth fueled by these attractive rates was short-lived.

Rates plummeted in 2020 and 2021 in response to the Coronavirus pandemic. By July 2020, the 30-year fixed rate fell below 3% for the first time. And it kept falling to a new record low of just 2.65% in January 2021.

Here’s a snapshot of what rates looked like from the 1970s until today. By contrast, if a company takes on excess leverage in order to buyback shares, it can contribute to lower financial resilience. When a company uses a buyback to opportunistically repurchase shares, the boost in share prices may be short-lived.

No comments:

Post a Comment